Best Gold and Silver IRAs 2023

All of that remains the responsibility of the client and whichever broker they have chosen to handle the purchasing of gold and other precious metals. No thanks, I’d like to stay las vegas review journal in the dark. Gold and other precious metals have been known to witness an increase in worth throughout periods of fiscal or administrative instability, as well as significant reductions in the stock market’s value, but this is not always the case. Failing to perform these background checks may place you at risk of losing your investment entirely. Costs and fees may be one of the toughest gold IRA company features to detail. Regal Assets was founded in 2003 with the mission of providing investors with a simple and efficient way to invest in precious metals. Searching for the best gold IRA companies can be a daunting task. They’ve also managed to earn thousands of 5 star reviews, with more than 12,000 clients across the US. As one of the best gold IRA companies, Noble Gold has a strong reputation for providing high quality customer service and expert advice.

What is Goldco?

Patriot Gold Club is a top tier gold IRA custodian, recognized for its superior customer service and expertise in gold investing. They also provide account holders with access to their gold IRA assets and provide guidance on the types of investments that are allowed in gold IRA accounts. News provided by The Associated Press. Overall, investing in a gold IRA can provide a secure and stable investment for your future, but it’s crucial to work with reputable and trustworthy custodians. If you are already on your retirement, be careful about who you will sell your assets to. They are also one of the most competitively priced gold IRA companies, offering fair and transparent pricing.

Tags

In turn, they can sell these to people at a reasonable price, while still making a significant profit. You can also only purchase eligible gold, silver, platinum, and palladium products to hold within your gold IRA. Their commitment to customer service and competitive rates make GoldCo one of the best gold IRA companies available. With the current uncertainties surrounding the economy and global events, many investors are turning to precious metals as a way to protect their wealth and hedge against inflation. Donna made a last ditch attempt to argue the text of the IRC permits her to personally hold gold and silver coins and retain the tax deferral offered by her IRA. The company has a young but experienced management team and highly trained staff that are always ready to help customers make informed investment decisions. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Thirdly, we evaluated the costs and fees of setting up and maintaining a precious metals IRA account with each company. Invest in American Hartford Gold for Financial Security and Peace of Mind. You shouldn’t just go with the most affordable one but will need to look at the company holistically and decide whether it meets your needs. Some gold IRA companies focus exclusively on IRA eligible bars and coins. In addition, Lear Capital offers several tools for investors.

What is Precious Metals IRA?

They all have the expertise and experience to help you make coin choices that will suit your financial goals for retirement. With precious metals IRAs, investors also have the option of rolling over their existing 401k or 403b accounts. Like a lot of excellent precious metals IRA companies out there, Birch Gold assures full transparency over their fees. Read full review of Regal Assets. Lear Capital is one of the oldest and most reputable gold IRA companies and has been selling and buying gold and other precious metals for more than 25 years. All in all, RC Bullion is one of the best gold IRA companies, making it an ideal choice for those looking to invest in gold. Gold by product metrics are non GAAP financial measures that serve as a basis for comparing the Company’s performance with certain competitors. As traditional 401ks and IRAs have stocks, mutual funds, and bonds, gold IRAs are a hedge against inflation as they hold physical gold, which is an actual store of value. Oxford Gold Group earns good ratings from the BBB A+ and Trustpilot 4. You have the option of sending your physical gold and silver coins to an independent insured depository or directly to your doorstep. You can buy items using funds from your IRA, or you can make individual purchases for your basic portfolio.

What Is a Gold IRA?

Finally, it is important to ensure that the broker or custodian is insured and bonded. You can open a new account online in less than 24 hours, and the company will assign you a dedicated account executive to walk you through the investment process. Their team of knowledgeable experts ensures customers are informed and confident in their investment decisions. All in all, Advantage Gold provides an excellent precious metals IRA service that is worth considering. View source version on businesswire. Furthermore, American Hartford Gold offers a variety of plans to choose from, allowing clients to find the best option for their needs.

What Exactly Is a Precious Metals IRA?

The gold dealer helps clients strategically use the metal as a hedge, whether they take possession of the gold or hold it in a retirement account. These are the most trusted and secure precious metals storage facilities in the United States. You can compare and review some top choices below. You will need to put a portion of your savings into assets that can maintain their value even under the worst economic conditions. The company charges several fees for their services, which vary depending on the services you require. They’ve expanded their services past precious metals, as they provide cryptocurrencies as well. On Augusta Precious Metals’ website. Many loan lenders offer gold IRA rollover services, but not all of them are trustworthy. Some individuals may purchase physical gold in the form of coins, jewelry, or bars, while others may opt for gold stocks or shares in royalty and mining companies. These options allow clients to diversify their portfolios and protect their wealth against economic uncertainties. Gold IRAs are a great way to diversify your retirement savings and help protect your wealth from inflation.

Overview of American Hartford

Gold Alliance is one of the best gold IRA companies. BCA: AAA From 95 Reviews. When comparing the best gold IRA companies, it is important to consider the fees, customer service and selection of products offered. Make sure to do your due diligence. Custodians are often credit unions, banks, brokerage firms, or other financial organizations that have obtained federal authorization to offer asset custody services. Discover the Power of Patriot Gold and Unlock Your Financial Freedom Today. Market Trends: The following chart from World Bank shows how gold grew gradually in 2020 before slightly declining.

Goldco Review

Once you become a customer, you will have access to a dedicated agent who can answer your questions and provide guidance whenever necessary. He made the process very easy. Free shipping on orders over $500. You will be assigned a dedicated agent who will act as your liaison, connecting you to other experts as well as providing you with all the educational materials needed to understand gold IRAs. The brokerage offers an expanded range of investments via registration with the world’s largest derivatives marketplace. You can only invest in IRA gold through a custodian. The company has 15 years of experience and has gained the trust of various types of investors. It offers a wide range of gold IRA products and services that are tailored to meet the needs of their customers. It is a type of Individual Retirement Account IRA, and it is managed by an IRA custodian. Other fees include a yearly insurance and storage fee of $100 and a yearly management fee of $75. For individuals interested in rolling over their current retirement funds into a gold silver IRA, the process is relatively straightforward. Invest in Your Future with RC Bullion: Secure Your Wealth Today. With an impressive track record of customer satisfaction and a commitment to providing high quality services, GoldBroker truly stands out in the industry.

Choosing the Best Employer Health Plan Takes Time

It also provides access to silver, making it the best gold IRA for gold and silver. This is an excellent way to receive help from experts when conducting any transaction or investing any money. In an uncertain economic landscape, it may be in your best interest to speak to your financial advisor about gold IRA investing. Multiple factors affect the price of gold including inflation, monetary policy and supply. As to which self directed IRA custodian you should choose, you only need to pick the one that you can trust the most. There are no additional fees from Lear Capital for maintaining your IRA, although there may be costs associated with buying, selling, and transfer of assets. I’m pleased with iTrust Capital and I’m excited to have a portion of my retirement accounts in crypto. During extreme market downturns, gold has historically has moved in the opposite direction of stocks. Next, you’ll transfer value from your traditional account to your new one, then choose your precious metal and order. Gold brokers at the firm consider each client’s specific goals when helping to find appropriate investment strategies. Here are some selling points. American Hartford Gold’s prices for their precious metals are close to market prices. This makes it a perfect safeguard against inflation.

Noble Gold: Cons Best Gold IRA Companies

Unlock the Potential of Your Money with Advantage Gold. Here’s what we like most about Goldco. Each of these companies offers its own unique services and benefits. Delaware Depository is a renowned site that carries a $1 billion all risk insurance policy through Lloyd’s of London. They have a good reputation in the industry, and all of their clients love their service and high quality products. Second, its fee structure is very competitive; it charges a flat rate of $250 per year for service and storage, with no additional transaction fees. Oxford Gold prides itself on its exceptional customer service, while Lear Capital is known for its competitive pricing and high quality products.

Outside Lands drops tasty lineup featuring nearly 100 restaurants

There are so many different companies to choose from, and each one claims to be the best. After that, the annual fee goes down to $180 per year. Be sure to ask any questions you may have about this investment type to ensure it aligns with your specific financial goals. Gold coins, for example, are popular for their collectability and numismatic value, while gold bullion is favored for its low premiums and liquidity. These companies provide custodian services for your IRA, which means they will hold and manage your account on your behalf. Traditionally, these instruments have held assets like cash, stocks, or bonds. Net loss income from discontinued operations. Here are some of the general benefits of investing in gold through a gold IRA custodian. Depending on the depository you choose to store your metals, you may owe an annual fee of $100 or $150. If you invest a minimum of $50,000, then you will have your fees completely waived for your first year. And investing in gold mines feels too risky.

Advantages of a Gold IRA

IRA Term Options: 1 year, 3 year, 5 year. Just like their gold counterpart, Goldco’s silver bars can be purchased for use in your precious metals IRA or to privately hold. Choosing a suitable gold IRA company is essential to achieve your retirement goals. RC Bullion is the perfect choice for those looking for a secure and reliable way to invest in gold and silver. ” These include stocks and exchange traded funds ETFs in gold mining companies, precious metals commodity futures or precious metals mutual funds. Gold can be an excellent investment for those who wish to safeguard their wealth over the long term and secure their investments. Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism. If you’d rather invest in gold that you can store yourself, you can buy physical gold through one of the companies on our list.

ReadLocal

GoldCo, Augusta Precious Metals, and The American Hartford Gold Group are all well known names in the world of gold investing. The company’s knowledgeable and experienced staff are dedicated to helping clients make informed decisions about their investments. No questions asked buyback policy. Don’t be bought into companies that say that your money is going to soar to astronomical heights with them. Just like traditional IRAs, a gold IRA allows pre tax contributions, meaning that the investment earnings can accumulate tax deferred. Next, you’ll transfer value from your traditional account to your new one, then choose your precious metal and order. Stay updated on the latest and trending precious metals. As a result, investors looking to increase their exposure to precious metals may want to consider opening a self directed precious metals IRA.

Advertising

Depending on your age, current financial position, and personal preferences, the answer to this question will vary per person. Another option to invest in gold is by setting up a Gold IRA. After carefully analyzing the data, the top gold backed IRA companies were selected based on their ability to provide the best and most comprehensive services. When he’s not creating content online, he’s spending time with his family in Washington, DC. Here’s a list of the best gold companies and some things you should keep in mind when you’re getting started. While this option might entail shipping costs, you can sell your gold on the market at your discretion. Uncertainty will likely continue to be a feature of the next ten years; thus, gold will likely continue to be a wise investment when people expect the worst.

Advertising

Most gold IRA companies will buy back gold or other precious metals they sold you, but these buyback programs are generally conducted at the wholesale price, which is about a third cheaper than the retail price. Gold IRA providers could have negative or positive reviews for a reason. These alternative paths to financial security as a senior citizen tend to be slightly more complex than traditional IRAs. You can also buy precious metals out of your retirement account and store them at home, but it’s riskier. Others, such as Lear Capital and American Hartford Gold, have been in business for over 20 years and have a proven track record of success. If you’re looking to diversify an existing IRA into precious metals, Lear’s staff can also assist with that. These symbols will be available throughout the site during your session. Companies that obscured their prices, had difficult or confusing policies and procedures, and/or limited investment and storage options were eliminated. Gold is often seen as a safe haven asset, and its price has historically been less volatile than other asset classes.

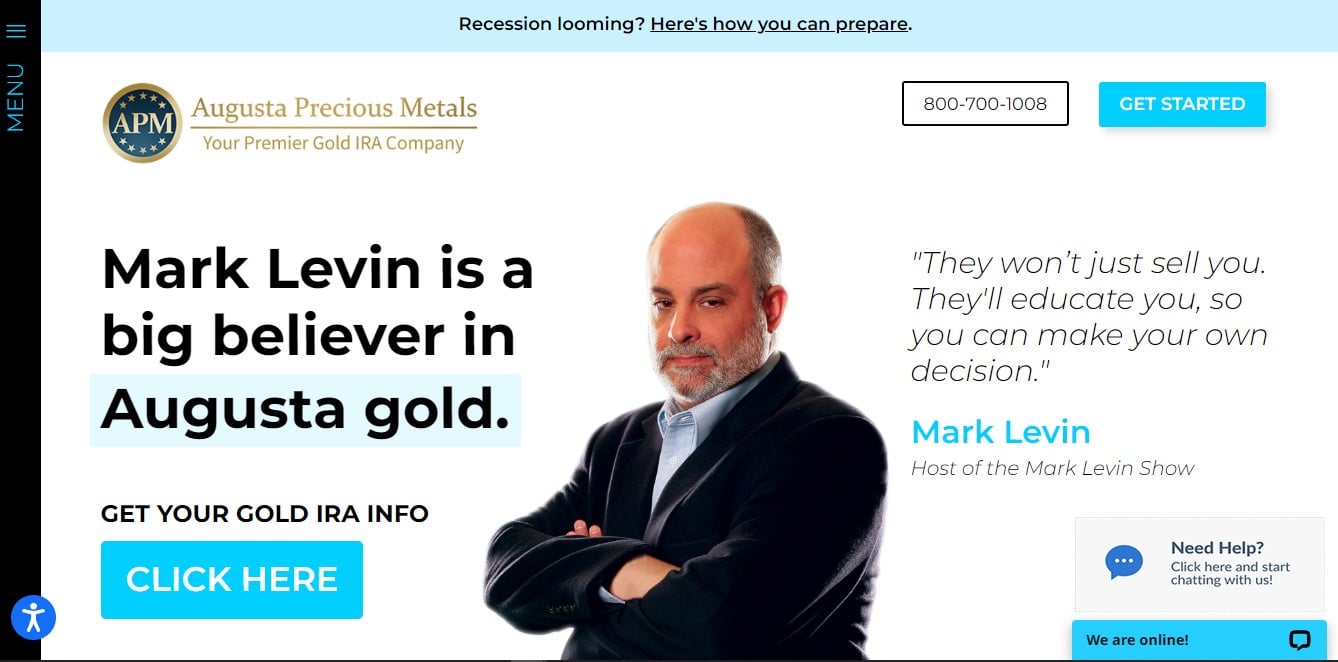

Augusta Precious Metals

Experience the Unparalleled Quality of GoldCo: Try It Now. Follow us on Twitter and Facebook for our latest posts. American Hartford Gold charges a $180 annual fee that may be waived for up to three years if an investor’s precious metal purchases exceed $100,000. Reviews of the Best Gold IRA Companies Final Thoughts. With so many options, it’s important to compare the best gold IRA companies to find the one that best suits your needs. Gold is a safe haven, meaning it retains its value even when other investments lose money. When looking for a broker or custodian, it is important to read gold IRA reviews and compare different companies. The American Hartford Gold Group is committed to helping clients make the most of their gold investments in IRA accounts, ensuring that their retirement savings are secure and that their gold investments are the best possible. Additionally, he helps individuals plan holistically for their future and make sensible, informed alternative investments, such as gold and digital assets. Birch Gold Group Runner up.